Patent Law Colloquium keynote speaker asks: Is Canada’s sovereignty at stake?

By Mark Witten

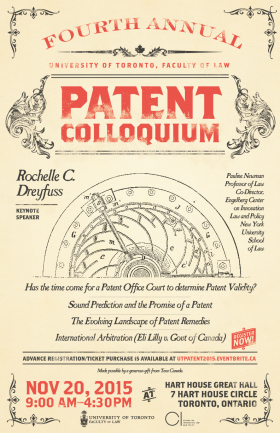

Changes in international IP law resulting from trade agreements pose a potential threat to Canada’s sovereign powers and ability to safeguard public health, said Rochelle Dreyfuss, a leading intellectual property expert and Pauline Newman Professor of Law at NYU School of Law. She gave the keynote speech at the fourth annual Patent Colloquium, hosted last fall by the University of Toronto Faculty of Law’s Centre for Innovation Law and Policy.

Dreyfuss cited the example of a complaint filed by pharmaceuticals multinational Eli Lilly against Canada under the North American Free Trade Agreement (NAFTA). Lilly is seeking $500-million in compensation because Canadian courts invalidated patents for two of its drugs: Straterra (an ADHD medication), and Zyprexa (an anti-psychotic medication). Should its claim succeed, Lilly will have significantly altered the authority of Canada, or any sovereign nation, to balance the protection of intellectual property rights against other domestic priorities, such as health, safety and culture.

“Handing control over the elaboration of intellectual property law to foreign investors through challenges to state action can have a profound social impact and insidious effects,” said Rochelle Dreyfuss. “It can affect health in the form of access to patented medicine, safety in the form of access to patented technology such as the Internet, and culture in the form of access to copyrighted media material. Nations need a united approach to withstand this pressure.”

Dreyfuss argued ongoing cases, such as Lilly v. Canada and Philip Morris v. Australia, highlight a number of problems with the current system of investor-state dispute settlement (ISDS) in the intellectual property space.

Settling disputes between nations through arbitration is far better than wars. But there are significant differences between arbitrating state-to-state disputes and investor-state disputes.

In Lilly v. Canada, the claim is that after NAFTA went into effect, Canadian courts changed their approach to the utility requirement of patent law. But not in a way that reflected the US approach to utility. “According to Lilly, that violated the intellectual property provisions of NAFTA, and under the agreement’s investment chapter, the new analysis of utility and its consequences amounted to a deprivation of fair and equitable treatment and an indirect expropriation of its property,” Dreyfuss said.

In Philip Morris v. Australia, the company challenged Australia regarding its law mandating that health warnings be dominant on a cigarette package. The trademark is harder to see and branding impact is diluted. Phillip Morris argued the result is contrary to international IP law. It amounts to an indirect expropriation of the company’s trademarks under an investment agreement between Australia and Hong Kong.

The problem is not the idea of dispute settlement, said Dreyfuss. Settling disputes between nations through arbitration is far better than wars. But there are significant differences between arbitrating state-to-state disputes and investor-state disputes. A closer look at these differences reveals flaws in the ISDS system. It needs to work better in balancing and adjudicating international IP law, investment and national sovereignty issues.

First, states are constrained by geopolitics. They must weigh the decision to pursue a case against other national interests such as peace and security, and the benefits of international alliances. Unlike investors, states must also consider how a decision might affect their own sovereign powers. “Lilly, for example, is free to argue that NAFTA froze each member’s patent law. It will never have to grapple with economic disruptions, epidemics, environmental concerns and other national emergencies that require government action. Nor must it respond to new forms of creativity or changing business models. Nations must,” Dreyfuss said.

She cited the example of how the emergence of patent trolls led the Supreme Court of the United States to change the law on injunctive relief. It’s not likely the US would ever argue it had given up its authority to adjust patent law after NAFTA.

Remedies are another key difference between state-to-state arbitration under the World Trade Organization (WTO) and ISDS arbitration. Dreyfuss noted that in the WTO, the remedy is law revision. But in ISDS it’s money. Philip Morris launched a parallel suit against Uruguay (like Australia) that set out a method of damages in the range of US$25-million to US$2-billion.

“This would go to a firm that earns something like twice Uruguay’s GDP. If you add on the substantial cost of defending these actions, the threat of ISDS can be enough to prevent countries from taking action that is in their best interest, even when they are complying with international IP law,” Dreyfuss said.

The arbitrators are different too. Those on WTO state-to-state dispute resolution panels are mostly drawn from government service and have diverse backgrounds. The arbitrators chosen for ISDS cases by ICSID, the World Bank’s arbitration centre, are mostly lawyers from developed countries.

“They have different levels of appreciation for a state’s responsibilities to all its citizens, as opposed to a firm’s responsibilities to its investors. The disposition of ISDS arbitrators to respect sovereign autonomy is likely to be very different from that of WTO panelists,” she said.

Burden of proof is an added concern. In a state-to-state dispute resolution, the complainant must show the other state violated the WTO’s TRIPS (Trade-Related Aspects of Intellectual Property) agreement. Investor-state disputes are different. Compliance with international IP law becomes a defense to an action for expropriation under NAFTA. So the party with the burden of proof in the Lilly v. Canada case is Canada.

Finally, WTO decisions can be appealed to a sitting panel of appellate judges. But ISDS rulings may be reviewed only for egregious types of error.

How have these two approaches to settling international disputes involving IP law taken such divergent paths? And once that’s understood, what can be done to solve the problem?

Dreyfuss said a prime cause has been the reconceptualization of intellectual property in international law from an incentive to innovate to a commodity, just like steel, cotton or sheep. Then came the assetization of IP.

“You had phenomena like Bowie bonds, securities backed by David Bowie’s IP portfolio. Soon the focus turned from incentives and commodification, to protecting IP as an investment. Any government action affecting the quality of these investments began to look like expropriation, or unfair and inequitable treatment,” she explained.

The reframing of IP from incentive to investment has had the collateral effect of exposing sovereign nations to a new threat. They face the prospect of costly actions by foreign investors with uncertain outcomes in a flawed ISDS arbitration system. This limits their ability to act in their best interest to balance incentives to innovate with public access to the fruits of innovation.

Dreyfess proposed some ideas to make the ISDS system work better and halt this reconceptualization trend, so as to realign international IP law with its innovation incentive roots.

She argued ISDS arbitration needs to better reflect world norms on regulatory decisionmaking and adjudication. That means “transparency, opportunity to be heard, reasoned decisions and right of appeal.”

Dreyfuss recommended fee shifting that would require the loser to pay the winner. This would deter challenges aimed at chilling lawful regulation.

The negotiation process and substance of international trade agreements also need to improve. Trade agreements are negotiated in secret and negotiators hear only from the IP rights holders. “Broader participation would alert negotiators to the delicate balance IP rights are supposed to represent, and thus produce better substantive outcomes,” she said.

Substantively, the exceptions and limitations in trade agreements are of crucial importance. Based on a preliminary analysis of the new Trans-Pacific Partnership (TPP) agreement, Dreyfuss was cautiously optimistic it may be moving in the right direction.

The TPP includes commitments to public health affirmed by the WTO. It states parties can advance public welfare objectives, such as public health, safety and the environment, without committing an indirect expropriation. For Canada, it also clarifies that fair and equitable treatment is about a genuine denial of justice, as measured by due process principles. “With that language, it should be harder to challenge a decision of the Supreme Court of Canada,” she said.

Sovereign nations need to work together on free trade and investment agreements that include IP property provisions and mechanisms that can be used to motivate innovation without damaging state authority to safeguard public values.

“Even states that are strong innovators right now must retain space to govern so that if, in the future, they are overtaken in some critical area, they can alter existing law and thus continue to protect their citizens’ welfare. Countries need to stand together to resist investors’ protectionist impulse,” Dreyfuss said.

* The annual University of Toronto Patent Colloquium is made possible by a generous gift from Teva Canada.